Cash remains the preferred form of consumer payment in Mexico, especially among the rural population, primarily due to limited knowledge of payment cards or poor access to banking infrastructure

Cash is primarily used to make small-value payments at retailers, and for the payment of utility bills, taxes and transport fares.

A significant proportion of the population is engaged in informal activities. These include including farmers, street vendors, domestic servants and self-employed workers.

Card penetration in Mexico stood at 138.4 per 100 inhabitants, which is lower in comparison to its peers Brazil (243.1), Chile (196.6), Argentina (178.4), and Venezuela (151.5).

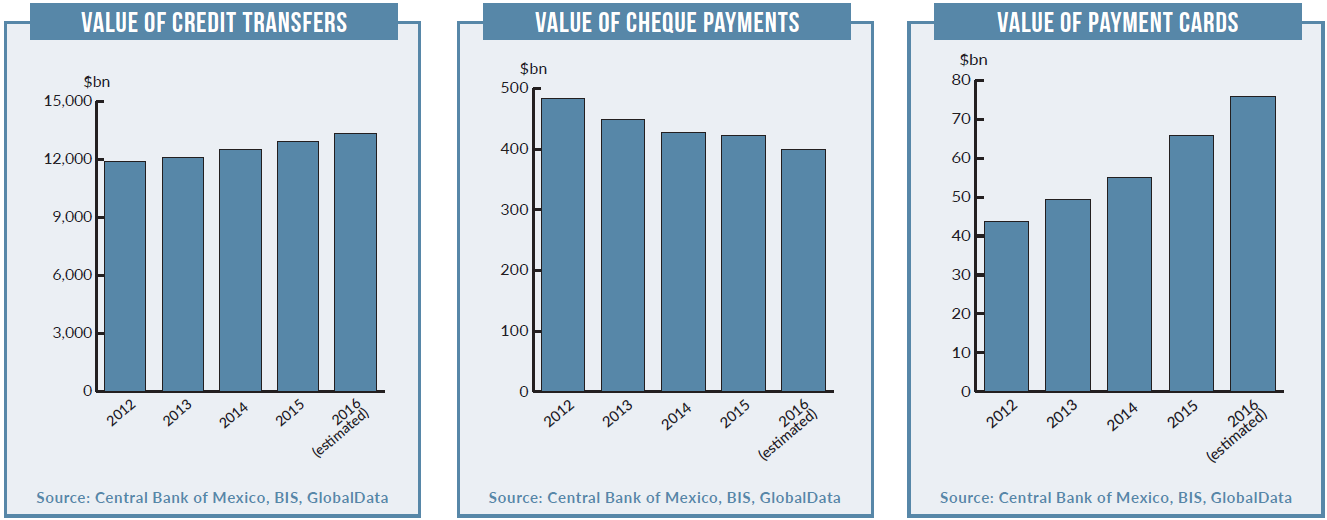

The low penetration rate is a result of the low banked population and the low level of financial literacy. As the government and banks have started to provide basic financial and banking services to the unbanked population – by expanding banking infrastructure, launching new branches, adopting the agent banking model, and making efforts to change consumer payment habits – payment cards have gradually become more accepted, with their use consequently growing between 2012 and 2016.

Financial inclusion

Financial inclusion

The government has identified access to financial services as a priority, and encouraged initiatives that make bank accounts essential for every individual.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

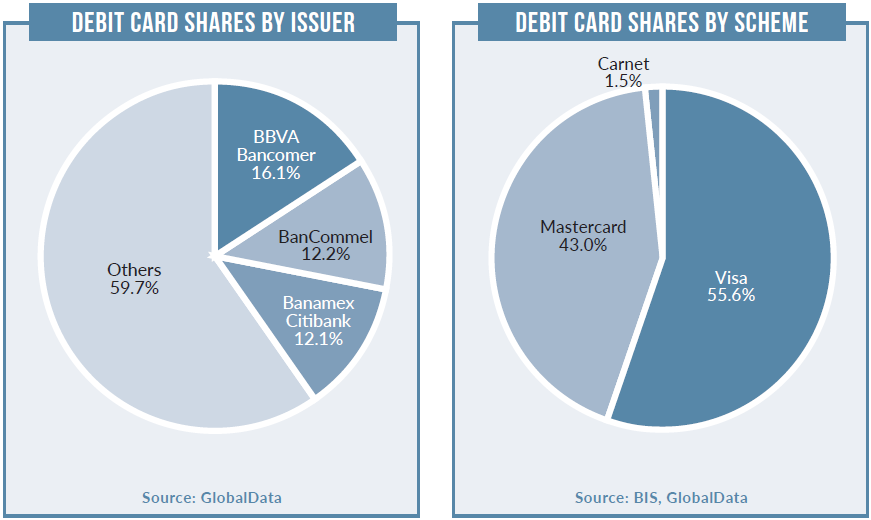

By GlobalDataThe central Banco de México has directed banks to simplify the process of opening bank accounts, making access to basic banking products such as bank accounts and debit cards easier.

Debit cards have grown in prominence with the introduction of electronic payroll services, a rise in the banked population, and the government’s distribution of social welfare funds through cards.

Mexico’s government is focusing on financial inclusion through three social benefits programmes: Oportunidades, Programa para Adultos Mayores, and Procampo, disbursing benefits through bank accounts and cards. These programmes are supervised by the Ministry of Social Development.

Banks have also supported the financial inclusion programmes, resulting in an increase in the banked population from 31.5% in 2012 to 46.8% in 2016, which has supported a rise in debit card penetration.

Credit card slowdown

Credit card slowdown

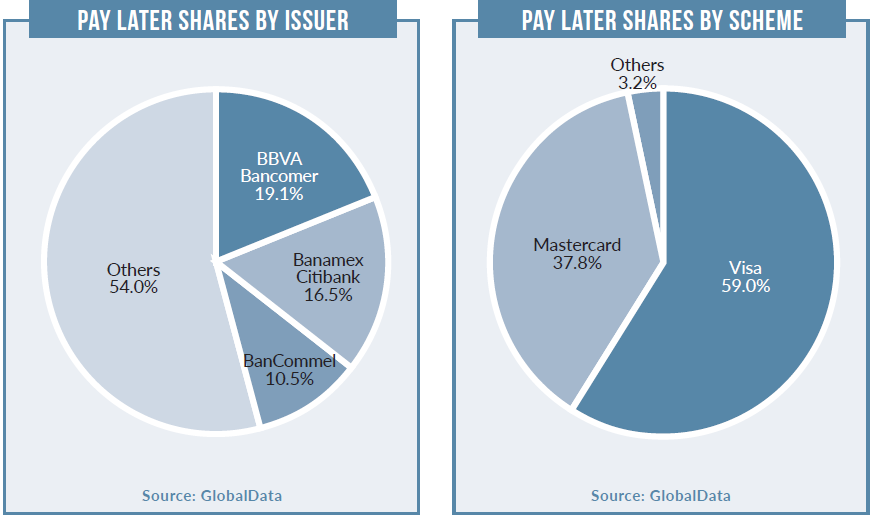

Despite its small size, the Mexican credit card market has recorded robust growth in terms of the number of cards in circulation, as well as transaction value and volume, supported by high consumer spending.

However, the market is likely to be affected by Donald Trump’s victory in the US presidential election. Consequently, banks are cutting credit card exposure to counter a potential rise in consumer defaults and the risks of an economic shock should the new US government restrict trade and business with Mexico.

Banks are therefore reducing credit card spending limits and raising consumer lending standards.

Banks’ profits would suffer if the US government scraps the North American Free Trade Agreement or discourages US companies from moving to Mexico.

Alternative payments

The Mexican e-commerce market posted a CAGR of 40.8% between 2012 and 2016, growing from $4.1bn (MXN85.7bn) in 2012 to $16.2bn in 2016, with the market anticipated to reach $35.8bn by 2020. Payment cards remain the most popular payment method among online shoppers, accounting for 60.8% of the total e-commerce transaction value in 2016.

In addition to payment cards, alternative payments such as PayPal, MercadoPago, DineroMail and SafetyPay are all used extensively for online shopping.

The availability of digital wallet services, and the security and convenience they offer, has made them popular among consumers. Mobile wallets, digital wallets, and carrier billing collectively accounted for 10.7% of total e-commerce transaction value in 2016, up from 5.1% in 2012.

Growing infrastructure

Growing infrastructure

The number of POS terminals recorded a CAGR of 11.1% between 2012 and 2016, rising from 621,628 in 2012 to 946,419 in 2016. The figure is anticipated to reach 1.3m by 2020.

In November 2014, the Mexican tax authority Sistema de Administración Tributaria (Tax Administration System) and the Confederación de Cámaras Nacionales de Comercio, Servicios y Turismo (National Chambers of Commerce, Services and Tourism) launched the Tableta Concanaco scheme to provide micro-enterprises and SMEs with mobile POS terminals at subsidised rates. As of February 2015, 20,000 mPOS terminals had been issued under the scheme.

The growing payment card market has prompted domestic and international solutions providers to launch POS terminals in the country. For instance, in May 2016 Banorte and Planet Payment, an international and multi-currency payment processor, launched currency conversion POS solution, Pay in Your Currency.

The solution allows international customers to pay in the currency of their choice, while Mexican merchants can continue to settle in pesos.

Financial inclusion

Financial inclusion Credit card slowdown

Credit card slowdown Growing infrastructure

Growing infrastructure