The French and Italian credit card markets could expand if issuers provide additional store discounts. But mobile wallet providers in India and China should reconsider their discounts, as currently this incentive is not encouraging credit card usage.

As per GlobalData’s Payment Cards Analytics, there are differences in credit card penetration across countries in the West and Asia. In the UK and Australia credit card penetration stands at 79 and 92 per 100 habitants respectively. By contrast, in India and China credit card penetration is 3 and 47 per 100 inhabitants. The lower penetration across Asia is due to mobile wallets dominating electronic payments, including WeChat and Alipay in China and Paytm in India.

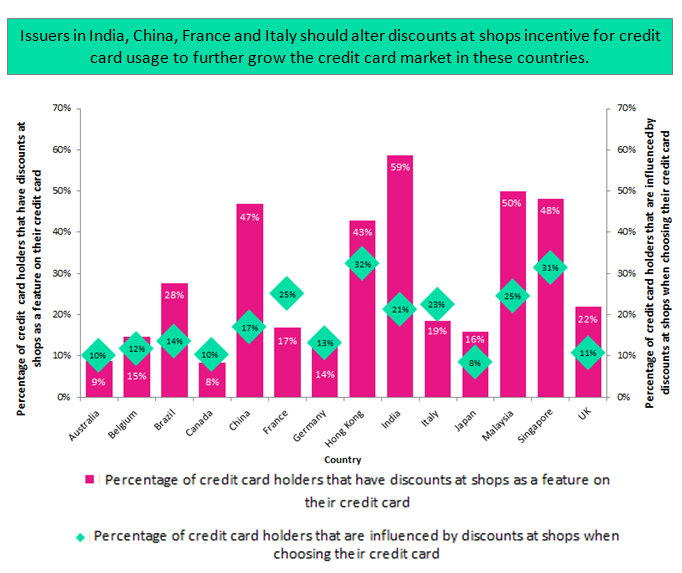

In addition to differences in penetration, the incentives provided to convince consumers to use credit cards also vary – particularly in terms of retailer discounts. Notably, GlobalData’s Credit Card Customer Analytics identified that 47% of respondents in India and 59% of respondents in China stated that their credit card offers discounts at shops as a feature.

However, just 21% of respondents in India and 17% of respondents in China are influenced by this benefit when choosing their credit card. This suggests issuers are partnering with merchants to provide discounts despite limited demand for such incentives.

Meanwhile, the Credit Card Customer Analytics dashboard identified that in France and Italy only 17% and 19% of respondents receive discounts as a credit card feature. Yet for 25% of respondents in France and 23% in Italy, retailer discounts would influence their choice of credit card.

Overall, there is no doubt that Asia lags behind the West in terms of credit card adoption, but there is still room for growth. To grow the credit card market further in the West, particularly in France and Italy, issuers should partner with more merchants to provide a greater variety of store discounts. By contrast, credit card providers in India and China should find alternative incentives to encourage uptake and usage.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Source: GlobalData’s 2018 Credit Card Analytics