Cash remains the predominant payment instrument in Indonesia, especially among the rural population.

It accounted for 98.3% of the total transaction volume in 2018, mainly as a result of the high unbanked population, inadequate banking infrastructure, limited consumer awareness of electronic payments, and low acceptance of payment cards at merchant outlets.

However, the government has taken various initiatives to transform the country’s payment landscape and bring more of the population into mainstream banking.

These include the introduction of a National Strategy for Financial Inclusion, the appointment of banking correspondents in rural areas, the migration of payment cards to EMV standards, compulsory use of electronic payments for toll road payments, and the launch of a National Payment Gateway.

Consequently, the number of payment cards in circulation, the transaction volume and the transaction value recorded robust CAGRs between 2014 and 2018 – a trend that is anticipated to continue over the next five years.

The emergence of contactless technology and e-commerce market growth are also anticipated to support an increase in the payment card market’s value.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataRising investment in POS infrastructure and the proliferation of new payment solutions will further promote electronic payments.

Debit cards hold firm

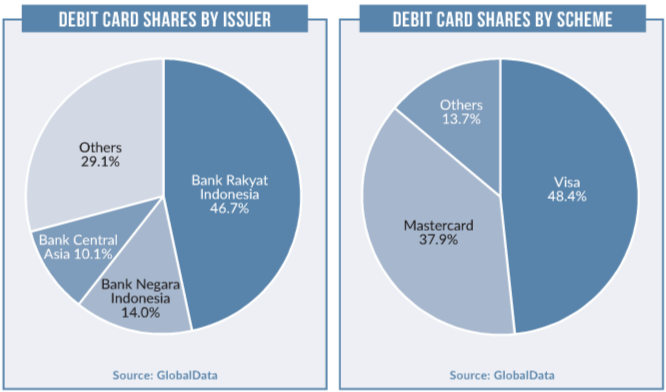

Debit cards remain the preferred payment card type among Indonesian consumers. The government and commercial banks have taken initiatives to bring the unbanked population into the formal banking system, resulting in the banked population rising from 36.1% of the total population in 2014 to 52% in 2018.

Debit card use is mostly restricted to ATM cash withdrawals, with frequency of use six times higher than for payments. This is primarily because both consumers and merchants still prefer to use cash.

However, as the government enhances the card-acceptance infrastructure, debit cards are being gradually used for payments.

Stricter regulation

Pay-later cards account for a small proportion of the payment card market, with overall penetration at just 6.6 cards per 100 individuals in 2018. Strict government regulations on credit card eligibility remain a primary reason for the low penetration.

The minimum monthly income to apply for a credit card in Indonesia is IDR3m ($221.05), with the number of credit cards held and credit limits depending on the individual’s monthly income.

In addition, in December 2017 the Indonesian central bank required all credit card issuers to submit details of transactions to the Tax Office.

E-commerce growth

E-commerce in Indonesia posted a significant CAGR of 47.5% over five years, rising from $2.95bn in 2014 to $13.95bn in 2018.

Rising mobile penetration, increasing consumer confidence in online transactions, extensive foreign investment, and the presence of secure online gateways have driven this growth.

While alternative solutions such as PayPal, Doku Wallet, iPayMu and BBM Money have driven e-commerce growth, consumers in Indonesia have also started to pay for online purchases by scanning QR codes displayed on merchant websites.

Shared ATM Networks

Although payment card adoption is low in Indonesia, accounting for just 1.7% of the total transaction volume in 2018, the government is collaborating with the central Bank Indonesia, payment service providers and banks to develop initiatives to boost electronic payments.

One example is the introduction of instant fund transfers that enable individuals and commercial customers to transfer funds in real time. Bank Indonesia also introduced a real-time gross settlement system, BI-RTGS, in November 2000, which settles high-value transactions, over $7,368.17, in real time.

However, the time window for transfers is between 6.30am and 4.30pm, which is a key limitation of the system. ATM operators ATM Bersama, ATM Prima and Alto have taken initiatives to develop a system to enable low-value interbank transfers at low fees.

For instance, national ATM operator ATM Bersama allows instant interbank fund transfers by member bank customers.

Unbanked population

The prepaid card market recorded a CAGR of 43.9% between 2014 and 2018 in terms of the number of cards in circulation – a trend that is anticipated to continue for at least five years.

Rising demand for prepaid cards has been supported by the country’s high unbanked rural population. As consumers become accustomed to using prepaid cards for daily transactions, issuers are looking to increase their customer bases.

Airline Citilink Indonesia collaborated with Bank Mandiri in October 2017 to launch a co-branded e-money card exclusively for Citilink Indonesia passengers. The card can be used to pay for travel purchases including flight tickets, and in-flight meals and beverages.