“90% of what we see today won’t exist in ten years’ time, but 10% of it will change the world,” Chris Larsen, Ripple’s CEO.

This statement might be the summary of it all. The world is constantly changing and with this change, new technologies and approaches are revealed, defining the future business and communications.

Global cross-border payments have been the main driving engine behind the recent international commerce great upsurge. However, in order to fuel this growth even further, new approaches and technologies must be utilised.

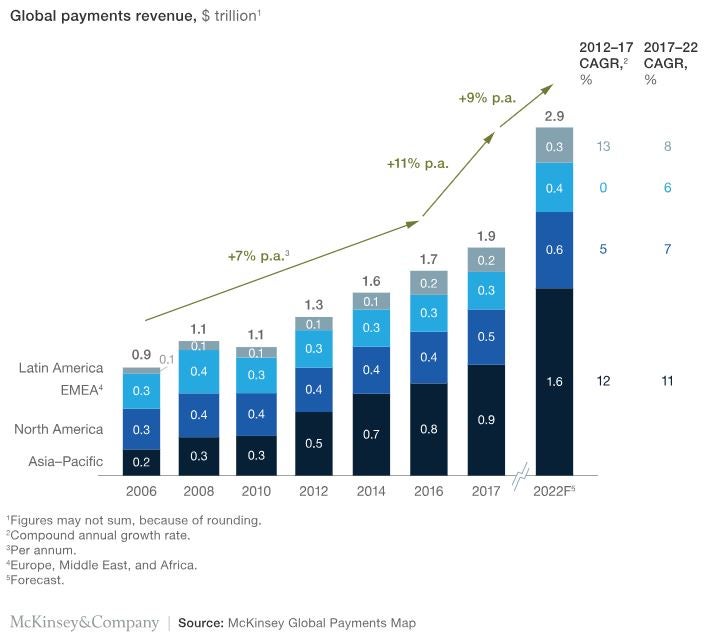

According to recent research released by McKinsey & Company, Global payments revenues grew 11% in 2017 (see graph below), which is the highest growth rate for the past five years and are expected to grow in a steady pace in conjunction with the growth we see in cross-border payments and across all international commerce segments. Companies such as Alibaba and Amazon are breaking records year after year, with smaller manufacturers and SME’s now, more than ever, are able to take advantage of less conventional payment solutions such as e-wallets, real-time payment systems and credit cards, allowing them to sell their products and services to a rapidly growing number of new markets and customers now connected to the digital commerce and ensuring increasing customer demand.

Global digital commerce volume exceeded $3 trillion in 2017 and is expected to more than double by 2022. Such enormous growth cannot rely solely on the current payment solutions and new, already existing, technologies must be utilized to support this growth.

The growth we notice is not passing over without complications. Growing demand for fast settlement, transparency, AML and regulatory constraints, push costs up and require new technologies to support further growth.

Blockchain platforms such as Ripple and others were developed to address each one of these constraints, implicating cross-border payments by providing a standardized, decentralized infrastructure; full visibility for fees, delivery and status; Transaction route optimization and costs reduction.

As the hurdles for blockchain based payment systems adoption are decreasing, more and more financial institutions are exploring ways to implement this technology in their core solution offering. As more financial institutions will embrace this technology than more SMEs will be able to utilise it to expand to new markets and segments.

What was once a slow, not-transparent and relatively expensive process might soon become much more frictionless and cost-effective, supporting the international commerce growth and even motivate industry leaders and newcomers exploring new technologies and approaches fueling this growth even further.

The UK-based electronic money institution (EMI) MoneyNetint, has recently announced the deployment of the blockchain-based payments platform developed by Ripple. This new service will enable merchants of all sizes, operating on a cross-border basis, to utilize the broad worldwide network of financial institutions partnering on the RippleNet to expand their operations while reducing costs.

Since the establishment of MoneyNetint in 2004, the company has positioned itself as one of the more reputable private payment companies in its field. Its platform enables the transfer of secure payments online through electronic wallets, local payment schemes and international bank transfers, as well as currency conversions in a fast and cost-effective way.

MoneyNetint is active in nearly 200 countries and leads a business strategy that allows SME’s operating worldwide to reduce barriers for online payments and bank services.

The core service provided by MoneyNetint allows merchants to open an e-wallet, which is connected to a local bank account, providing the ability to receive payment for services or goods locally and without the need in cross-border rails. This solution also provides the capability to pay suppliers in their local currency by a local transfer saving vast amounts on FX conversion rates and international transfer fees.

This new partnership with Ripple adds another layer of capabilities for MoneyNetint’s clients to reach new markets that were too difficult or too costly to reach.

MoneyNetint positions itself as a payment service provider for those corporates which operate globally in more than one country and in more than one currency. The MoneyNetint payment system was designed in a way which allows the management of the entire payment cycle, from receiving payments to paying invoices and salaries, in a secure, inexpensive and user-friendly way.